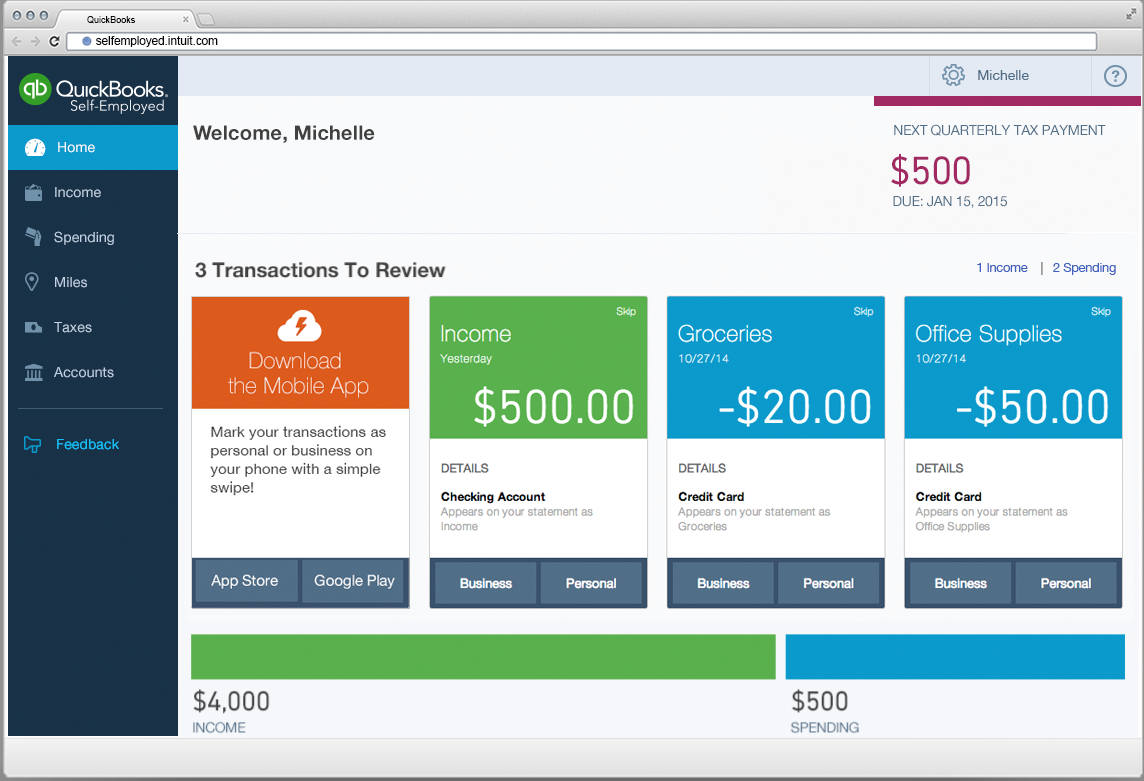

QUICKBOOK FOR PERSONAL BUDGET SOFTWARE

(And you don't take our word for it check out all our 5-star reviews to see why Cube is the best personal finance software for your business.) 1. Hundreds of world-class FP&A teams at companies of all sizes use Cube to quickly and confidently analyze, plan, and collaborate in the spreadsheet (where they prefer to work anyway). We’ve covered all the best finance software on the market today, and yes, we’ve started with Cube. We know you’re going to do the research, so we did it for you.

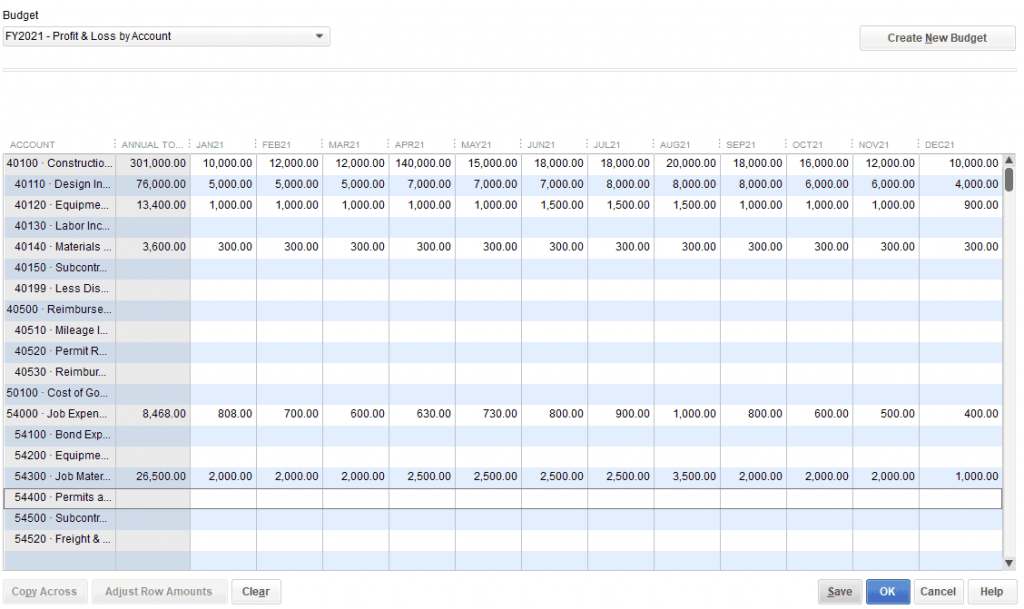

While some finance software is free, most of the best finance software comes with a monthly or annual subscription fee. Budgeting software is focused on helping users track their spending and create a budget, while finance software includes features like invoicing, expense tracking, and reporting. The difference between budgeting software and finance software is that finance software covers a broader range of features than budgeting software. Personal finance software typically includes features like budgeting and investment tracking, while business finance software includes additional features like invoicing and inventory management. You can use this software to track income and expenses, prepare financial statements, and manage accounts receivable and payable. You can use this software to track your spending and budget more effectively and make investment decisions.īusiness finance software is used by businesses to manage their finances. business finance softwareįree personal finance software is for individuals to manage their personal finances. Often, finance software can encompass accounting software. Accounting Software: This software helps you keep track of your income and expenses, prepare financial statements, and manage your accounts receivable and payable.Īccounting software assists accountants and bookkeepers as they record and report on a firm's financial transactions.įinance software focuses helps FP&A and the Office of the CFO manage the business's assets and liabilities while also planning for future growth.Tax Software: This type of software can help you prepare your taxes, find deductions, and file your return electronically.Investment Software: This type of software can be used to track your investments, monitor the stock market, and make investment decisions.It can be used to track your investments, set goals, and develop a plan to reach those goals. Financial Planning Software: This type of software helps you plan for your financial future.You can use budgeting software to set financial goals and track your progress over time. Budgeting Software: This type of software helps you track your spending and create a budget that you can stick to.Let’s get a little more in-depth into the various types of financial software. Finance software these days is multifaceted, so it's important to look at each solution and see where its strengths lie. Financial statement and report programs.This software can be used to track spending, budget more effectively, and even make investment decisions. Financial analysts and investors often use specialized software to help them make budgets and reports, develop financial forecasting, and for other financial planning and analysis (FP&A). There are a variety of software programs that are used in the finance industry. What software is used in the finance industry? Best finance software for personal finances.What software is used in the finance industry?.Whether that's for tracking historical data, reporting and compliance, or budgeting for and predicting the future.īut with all the finance software out there right now, you're swimming in options. Any modern business needs finance software.

0 kommentar(er)

0 kommentar(er)